The startup aiming to get Elon Musk’s attention

Doron Myersdorf is trying to get the attention of Elon Musk, founder of Tesla.

Myersdorf is moving his en year old company, StoreDot, from the initial fast charging battery pouch cell it developed to a new chemistry and a new form factor. Both are aiming at electric cars rather than the previous drone and industrial applications.

“We have taken a strategic decision to focus on the EV market,” said Myersdorf. This will use the 4680 cylindrical form factor proposed by Tesla for its next generation high volume production line. “We are moving from germanium in the anode to silicon which is much more cost effective and available. Eventually this will come to a lower price than today’s graphite anode battery,” he said.

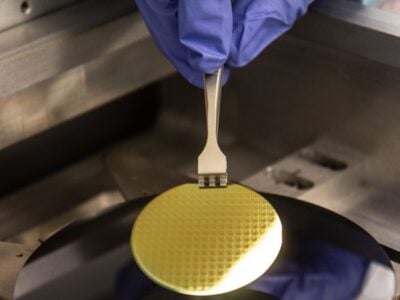

“For Gen one we demonstrated pouch cells but for Gen two we have 10Ah cell large format based on silicon in pouches (shown above),” he said. “We are also producing the 4680 cell – we have some innovation in the cooling as the faster you charge it the more thermal issues you have, we have patents which will be interesting for Tesla, to get Elon’s attention.”

The technology and challenges are similar from the first to the second generation. “In Gen one we also had the swelling challenge as Germanium and silicon are similar, and the work we do with the nanoparticles and the coating that protects the material is similar. It has been an effort of several years to control that swelling and we are replicating that methodology with EVE Energy. We have developed a proprietary organic coating,” he said. “It still swells but the nanoparticles means it swells inside the battery and keeps the swelling to 15 percent.

Next: Solid state battery tech

“The major difference is the fact that germanium can be mixed with water and nanosilicon cannot as it reacts with the water. So we had to develop specific organic solvents for the slurry so there are more challenges with the slurry preparation to build the cells.”

The project with Chinese battery cell maker EVE Energy also started on Gen2 in an existing battery production line, and Myersdorf expects to show those silicon cells later in the year

“The scale up capability is there but we are not using this yet. We want to demonstrate the Gen2 capability. It has the capacity for [cells for] 50,000 cars a year and we are working with additional providers. Depending on demand, through partners, not through StoreDot, we want to move very fast into the EV market.”

The Gen1 launch is a technology stepping stone to reach the market in mass production with a supply chain for the nanoparticles, he says. “We are in negotiations for a joint venture and they will commit to captive capacity for this technology. Whoever has capacity is king and that’s critical,” he said.

One of the investors is car maker Daimler. “We do have Daimler – but there’s no exclusivity and they are supportive of us finding other partners,” he said.

Another of the partners, bp, has been key to the change in strategy. Rather than charging an entire vehicle battery pack in five minutes with an very high power charger, the emphasis is matching the charging infrastructure.

“The parameter that is critical for the driver as a new goal is not five minute charging but the miles per minute in the charging station,” he said. “Today its 3-4 miles/min, Tesla superchargers can do 6. We are targeting 20 mile per minutes which will give roughly 100 miles in that five minutes. The reason we are not going to a full charge in five minutes is we are trying to go and in hand with the infrastructure upgrades.”

“BP needs to repurpose forecourts and the grid upgrade and the new standards for fast charging will allow a full charge in more like 10 minutes in 2025 in a vehicle in the market with 50 to 60kW battery packs with a 350kW charger,” he said.

Solid state battery

But even the second generation technology is a stepping stone to solid state batteries. These are further out than companies such as Foxconn and Nio expect for production in the next year.

“We are looking at solid state further down the road for extreme energy density in 2026 to 28 so we are working on Gen3 and we have a technology lead there, but this is at least 5 to 6 years before that’s ready for production,” he said.

The challenges that solid state batteries face for production are still not solved, he says. “All the problems that we saw in Gen one over the last two years for scaling, they haven’t even begun to see those challenges in solid state batteries so it will be five to six years before we see that in production,” he said.

Long before that, he aims to be a major player in the EV battery world alongside Elon.

Related articles

- US TAPS ISRAELI CLEAN ENERGY TECH WITH $17m FOR PROJECTS

- WORLD FIRST OF FIVE MINUTE DRONE FAST CHARGING

- STOREDOT SIGNS CHINESE MANUFACTURING PARTNER

- BP INVESTS IN ULTRA-FAST CHARGING BATTERY COMPANY

Other articles on eeNews Power

- MPS taps EPC for 48V GaN DC-DC converter

- Material boost for solid state battery technology

- $10m for grid optical sensor platform

- Funding boost for UK second life battery startup

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News