Bitcoin mining takes advantage of fluctuating power

With bitcoin topping a record value of $50,000 and the mining process taking as much as a large country, a US startup has come up with a way to use

The process of mining bitcoins takes a lot of GPUs or dedicated ASIC chips and a lot of power. Research at the University of Cambridge calculated that the process uses over 121TWh of energy a year, more than Argentina, and it is the cost of energy that is the greatest operating cost for the generation of bitcoin.

At the same time, power plants frequently have to stop generating power to keep the electricity grid in balance. Utilities in Arizona were frequently paid by California electricity producers to take excess energy to avoid overloading their infrastructure due to excess supply of electricity, and 71 percent of power plants in California produce less than one third of their generation capacity due to excess supply.

Renewable energy such as solar and wind energy increases the likelihood of large supply swings and the need for better management of those sources. Over 80,000 MWh of solar and wind power was halted from load imbalances in California alone.

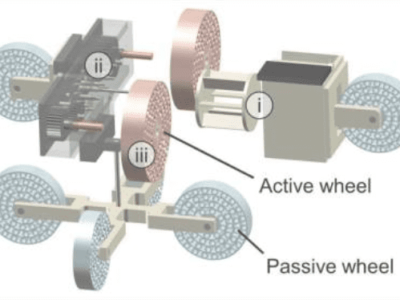

So Digital Power Optimization (DPO) in the US has developed a Cryptocurrency Mining as a Service (CMaaS) system that puts cryptocurrency mining computers behind the meter in power plants to generate bitcoin from low cost energy in the down times.

Putting these arrays of GPUs “behind-the-meter” limits regulatory issues with energy supply, and the power plant or grid operator can be the owner of the mine, located on land also owned by the plant or grid itself, again reducing regulatory hurdles, says Andrew Webber, CEO of DPO.

DPO sources and optimizes the mining computer mix of ASICs and GPUs and acts as the mine manager in exchange for an appropriate and negotiable fee. The power supplies for the GPU mining racks can use any type of power plant, solar array, electrical grid or wind farm depending on power production profile, regulatory dynamics, and associated energy costs.

This even works as the cost of bitcoin falls as the cost of the energy is so much lower and less miners in the market means the bitcoins mined are shared among a smaller group.

“The DPO model harms no one and makes the overall process of producing and transmitting power and energy at profitable prices easier to manage and more carbon efficient,” said Webber, who previously worked as a banker for Goldman Sachs.

He is now looking for energy partners to install and use the CMaaS service.

Related articles

- 1800W SUPPLY TARGETS CRYPTOCURRENCY MINING

- EUROPEAN COMPANIES DRIVE OPEN SOURCE VIRTUALISATION AND CONSOLIDATION FOR THE GRID

- ENERGY MANAGEMENT CODE GOES OPEN SOURCE

Other articles on eeNews Power

- BritishVolt gigafactory founder tries again in Italy

- Sony looks to open source cloud microgrid

- Empower sees boost from MLCC shortages

- Rohde & Schwarz enters power source market

- Reference design for programmable USB-C power adapters

- UK opens battery module and pack line

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News