Europe drives venture capital boom for battery storage and smart grid companies in 2019

The boom in smart grid and battery storage funding comes against background of a fall in total corporate funding. Total venture capital funding, public market and debt financing for these companies to $2.3bn in 1H 2019, down four per cent from $2.4bn according to the latest report from the Mercom Capital Group.

The decline in funding in 1H 2019 was due to lower funding activity in Smart Grid companies, while funding increased in the Battery Storage and Efficiency sectors. VC funding in Battery Storage companies in 1H 2019 was up by 139 percent with $1.4 billion in 17 deals compared to the $543 million in 30 deals in 1H 2018. The increase was spurred by Northvolt’s $1 billion funding round.

The Top five VC funding deals in 1H 2019 were: Northvolt’s $1bn raise, Sila Nanotechnologies raised $170m, Romeo Power secured $88.6m, Zenobe Energy secured $32.3m and LivGuard Energy Technologies raised approx $32m. A total of 41 VC investors participated in Battery Storage funding in 1H 2019.

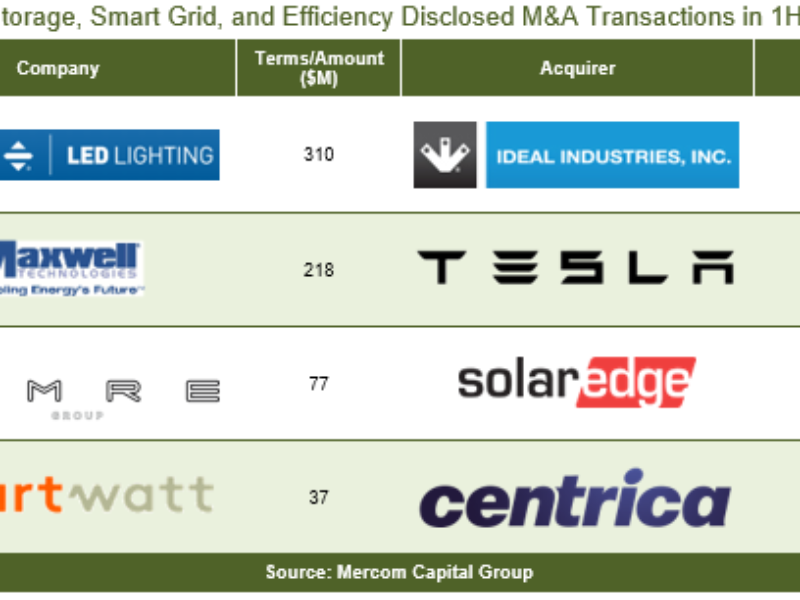

Debt and public market financing activity in the first half of 2019 ($547 million in five deals) was 275 percent higher compared to the first half of 2018 when $146 million was raised in six deals. There were four announced Battery Storage project funding deals in 1H 2019 bringing for a combined $499 million compared to $34 million in four deals in 1H 2018, with six mergers compared to eight transactions in 1H 2018.

However VC funding in smart grid companies in 1H 2019 was 11 percent lower with $120m compared to the $135m raised in 1H 2018. The Top five VC funding deals in 1H 2019 were: SmartRent at $32m, CleanSpark at $20m, Innowatts received $18.2m, Wirepas raised $16.2m and Driivz raised $12m. A total of 48 VC investors participated in Smart Grid funding in 1H 2019. Debt and public market financing for Smart Grid companies came to just $1m compared to $1.3bn in two deals in 1H 2018.

The first half also saw signficant smart grid consolidation with 17 mergers compared to five transactions in 1H 2018.

The VC funding for Energy Efficiency companies in 1H 2019 was 25 percent higher with $207m compared to $165m in 1H 2018. Kinestral Technologies raised $100m, Budderfly raised $55m, Carbon Lighthouse secured $32.6m, and METRON received $11.3m.Debt and public market financing was also 74 percent lower at $56m.

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News