Shaking up the industry with 3D printed solid state batteries

Sakuú in California has raised $62m to shake up the battery manufacturing business. While the company still sees a need for the battery gigafactories currently being built, it

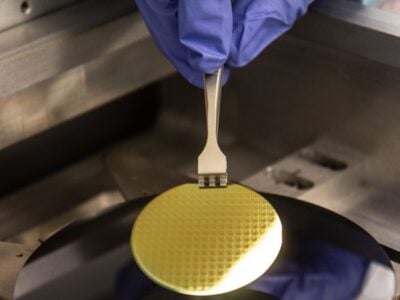

The company, formerly called KeraCel, has developed what it believes to be the world’s first true multi-material process additive manufacturing platform for solid state batteries. The first generation solid state battery will be the first in high-volume production in the second half of 2022, but it is the following generations that will shake up the way batteries are built, from electric vehicles to energy storage and consumer systems.

“We have two generations of solid state batteries,” said Nad Karim, co-founder of Sakuu. “The first one is similar to today’s pouch cells in its constructions and that means we don’t need to build huge factories of our own, we can use existing plants but despite this, it’s still solid state and high energy density and won’t catch fire.”

Sakuu has built a pilot plant in San Jose, California, with a capacity of 2.5MWh /year for sampling and used as a learning centre for contract manufacturing partners (CEMs) to bring up the first generation cells in their factories. “This will be the world’s first solid state battery in production” said Karim. The energy density of its first-generation battery has increased from 40Wh/l to 600Wh/l, while increasing the cell layer count from 1 to 30 while growing cell capacity from 2.3mAh to 3000mAh.

Th pilot line uses technology from Honeywell and Relevant Industrial who are taking Sakuu’s proprietary technology and scaling up the lab environment into a fully functioning pilot manufacturing plant for solid state pouch cells.

The company has one partner in Germany, one in Taiwan and some in the US to bring this product to mass production, he says. “That’s in process right now and we expect to be in production 1m 3AH cells by mid 2022. One of our lead customers is Musashi [Seimitsu Industry] in Japan and these products are for electric bikes through a contract manufacturer.”

Related articles

- World’s first commercial solid state battery 3D printer

- Sakuú teams for 3D printed solid state battery pilot line

- Solid state battery market to hit $6bn in 2030: report

- QuantumScape sets up solid state battery pilot line

Then there is the second generation solid state battery that can be 3D printed with additive manufacturing (AM) process.

Next: 3D printing solid state battery cells

“Gen2 will be fully 3D printed and have great deal more energy sampling by the end of next year,” said Karim. “Today’s batteries vary from 300 to 600Wh/l depending on the applications. This will have 1200Wh/l and a longer life cycle.”

“EV batteries typically have a lifetime of 400 [full discharge] cycles but you need 1000 full cycles so you reduce the duty cycle and only charge between 20 percent and 80 percent. The disadvantage is you leave the energy of the battery unused.”

“Our Gen1 cell will have 400 cycles and Gen2 will be above 1000 full cycles, 100 percent depth of discharge and we are hoping to achieve several thousand cycles,” he said.

“Gen2 requires our printers and some other ancillary equipment but the big advantage is this is 30 to 40 percent less capital equipment and less processing steps so you can make batteries faster,” he said. “With AM you have the great advantage of not having to build a large factory, you can build the batteries as you need them, where you need them.”

The Sakuu1000 3D printer will be available in early 2022 for early development, but it is the Sakuu3000 that is the key, says Karim.

“This can produce the equivalent of 180,000 1860 cells per month, so with 30 to 40 machines for a GWh factory.”

The company is also looking at producing solid state prismatic cells. “Our output for the car industry will look like a brick with no wasted space, but other industries such as consumer electronics may want a curved surface. For example in a smartphone you could make a conformal battery that is the inverse image of the electronics. It doesn’t have a thermal runaway so it can sit at 50C in the phone.”

“With our batteries they are physically solid to start with and don’t need a mechanical casing but the other thing is the way we seal the battery is by depositing a 50 micron layer of electrolyte around the casing so it has a much higher ratio of active material,” he said.

Other related articles

- Stellantis bets €30bn on solid state batteries

- II-VI enters lithium sulfur market for solid state battery cells

- £25m for UK EV solid state battery production

- €8m commercial solid state battery project for electric vehicles

- Sumitomo, Kyoto team on solid state batteries

- Patent filing marks start of roll to roll flexible solid state battery

“EVs are the biggest demand and our ‘go to market’ is entirely driven by the strategic partners, Mosashi and several others. The demands on battery pack development are simpler to two wheeled systems, so it’s a quicker time to market and an easier vertical to get into and that is led by Mosashi,” he said. “We also have partners in consumer electronics and home energy storage, among others, and the two wheel and consumer batteries will be in production before four wheel systems.”

As a startup, the company direction is determined by partnerships with the strategic investors and manufacturers. “At the moment we are only engaging in customers investing time, resources or money into us and expand from there,” said Karim.

“There are ways and means to reassure customers how to maintain supply but even with Gen2 it is not our intent to build massive gigafactories. We plan one Gigafactory, looking at Kansas anor Idaho, built probably from government loans,” he said.

Instead he sees smaller, local factories alongside the equipment plants.

“There is a lot of CO2 emitted in battery production, and a factory that is 30 to 40 percent smaller will have less emissions so it’s really the manufacturing process that is simpler, quicker and uses less energy. And doesn’t take into account the cost of transporting the batteries.”

This is a key advantage for strategic partners, he says.

“A lot of our customers will be setting up their own factories using our equipment, leasing the equipment and licensing the technology – the material supply is critical and we are working with large suppliers to ensure supply and our customers will be able to buy from our partners or elsewhere.

The technology can use a customers’ choice of cathode and anode, which could have no cobalt or high nickel, so there is a lot of optimisation. For energy storage for example, the cells use lithium iron phosphate (LFP), for mobile its NMC lithium ion. “When we engage with the customer both engineering teams work on performance, energy density, power density and cycle life and based on that we design the specific recipe, and that recipe is then licensed and in this way we have built up a portfolio of different battery types,” said Karim.

Sakuu is working on a third generation technology with a a high voltage cathode.

“The cathode we are using is stable up to 9V rather than 4.2V,” said karim “Gen1 has been tested with a 5V cathode for 800Wh/l and once we are in production with Gen2 with standard cathodes to 1200Wh/l we will work with cathode suppliers for a HV cathode. With a 9V cathode we could achieve 4x the energy density in theory, that’s 2400Wh/l, so Gen3 is a another massive leap in energy. That will be sampling by the end of 2023 with production in 2024,” he said.

The latest funding round is a key step in this process.

“I am incredibly grateful for our investor’s continued support. This funding will allow us execute on our key objectives: commercializing the world’s first true multi-material, multi-process additive manufacturing platform; expanding our R&D team; and continuing to develop advanced materials and groundbreaking active devices.” said Robert Bagheri, CEO and Founder. “We are expanding our operations to support our pilot lines and in preparation for the commercial launch of the Sakuú 1000 AM platform, which will enable our customers to unlock breakthrough products and achieve industry leading performance metrics across multiple parameters,” he said.

Other articles on eeNews Power

- AMTE Power looks to UK battery Gigafactory

- Siemens buys French power startup to boost IoT systems

- World’s longest subsea HVDC link opens

- Prize for perovskite solar cell researchers

- ABB launches 360kW EV fast charger

- Online power simulator runs in browser

- Megawatt charging network for long-haul trucks

- Atmosic teams for energy harvesting remote controls and smart homes

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News